News&Comment

News:

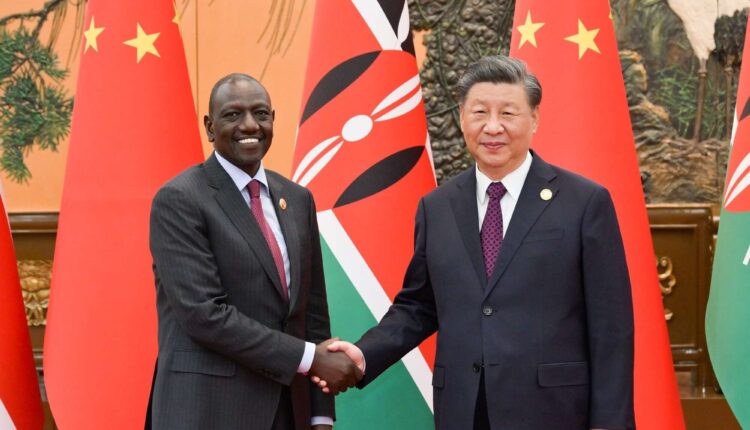

Kenya has secured a Ksh.40 billion loan from China to help unlock stalled projects in 15 counties. National Assembly Budget Committee Chair Ndindi Nyoro said the deal inked by the two countries will see contractors go back on site as soon as the month of September

Comment:

It is the pursuit of structural transformation of their economies that put countries like Kenya in the grip of borrowing hence causing rise in debt levels. To embark on structural transformation of the economies many African countries requires massive investments in infrastructure which are supported by borrowing from both the domestic and external markets. It is in this regard, the Government has decided to access a new loan from China. Notably, Kenya has already spent sh.152.69 to repay debt due to china in the just ended financial year underlining the burden to taxpayer in servicing the loan taken to build the modern rail line.

When Ruto administration entered in the office in August 2022, country’s external debt was about $62bn, or 67 percent of its gross domestic product. The last regime upon which William Ruto serves as deputy president had borrowed heavily from commercial lenders and countries like China to finance huge infrastructure projects, including a rail line that links Nairobi to the port city of Mombasa. Most of those loans were commercial, meaning they had high interest rates. Meanwhile, the infrastructure failed to generate the expected revenue. More worse, numerous African leaders who borrow money from abroad, they expropriate the funds for personal use, and leave the debts to the population they ruled.

In the protests two months ago that turned deadly, placards were raised denouncing the International Monetary Fund (IMF) and World Bank, which were accused of causing the crisis. “IMF, World Bank, Stop the Modern Day Slavery,” one placard read. The protests indeed were as results of corrupt Capitalist policies such as increasing the taxes and seeking loans which have caused immense pain and hardships not only in Kenya but the whole world. Apparently, seeking loans was a design tool used by the west who cultivated a small group of local people (leaders) who would fuse political and commercial power to control the economy of the third world countries like Kenya.

To cut off the monster of borrowing Kenya and the world at large needs a new model of economy which is none other the Islamic Economic system which focuses on distribution and circulation of wealth rather than production and accumulation of wealth within handful elites. Furthermore, with a bimetallic currency based on gold and silver only, interests based loans have no chance in the Islamic economy. Indeed this unique system will be implemented under the Khilafah (Caliphate) State that will be re-established upon the method of Prophet Muhammad (saw).

Written For the Central Media Office of Hizb ut -Tahrir by

Shabani Mwalimu

Media Representative of Hizb ut-Tahrir in Kenya